How to Give

Via our secure online giving form.

Make all checks payable to: Piedmont Council, BSA and mail to 10 Highland Way, Piedmont, CA 94611

Make your donation go twice as far by checking with your company’s Human Resources department to see if they match charitable donations made by their employees. Click here for a list of some of the companies that offer matching programs.

Tax ID 94-1156325

Mail checks and matching gift forms to: Piedmont Council, BSA, 10 Highland Way

Piedmont, CA 94611

Donating securities, including stocks or bonds, is an easy and tax-effective way for you to make a gift to our organization. A gift of stocks or securities to Piedmont Council can be arranged via electronic transfer or by receipt of stock certificates. The gift provides a full income tax deduction and negates capital gains taxes.

Donating appreciated real estate, such as a home, vacation property, undeveloped land, farmland, ranch or commercial property can make a great gift to our organization.

Tax Benefits

Immediate income tax deduction for the charitable value of the gift, plus no capital gains tax due.

Other Benefits

Can allow you to live in your home and still receive a charitable deduction.

Donating part or all of your unused retirement assets such as a gift from your IRA, 401(k), 403(b), pension or other tax-deferred plan is an excellent way to make a gift to our organization.

A gift of your life insurance policy is an excellent way to make a gift to charity. If you have a life insurance policy that has outlasted its original purpose, consider making a gift of your insurance policy. For example, you may have purchased a policy to provide for minor children and they are now financially independent adults.

Tax Benefits

Immediate income tax deduction for gift’s value, plus possible estate tax savings.

Other Benefits

Provides a way to make a significant gift with little expenditure.

Description

A trust you establish to take effect during your lifetime.

Tax Benefits

Possible savings in estate taxes if Piedmont Council, BSA is the beneficiary of the trust remainder.

Other Benefits

Terms of the trust can be changed at any time.

Description

A trust that pays a set or variable income to you or those you name before Piedmont Council, BSA receives the remainder.

Tax Benefits

Income tax savings from deduction, no capital gains tax liability, possible estate tax savings.

Other Benefits

Provides fixed annual income for donor or other beneficiary (annuity trust); income could increase if trust value increases (unitrust)

Why We Give

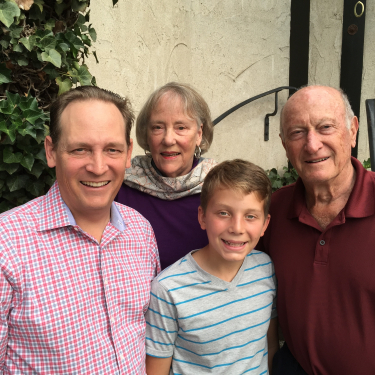

“Citizenship. Perspective. Community involvement. Independence. Collaboration. These are the qualities and strengths Scouting provided our son and still provide our grandchildren. We are proud to financially support Piedmont Scouting as it continues to enrich our community.”

– Tom and Sue Smegal, son Tom, Piedmont Eagle Scout 1985, and grandson Tommy, Troop 11